China’s stock market is unique and complex, featuring different types of shares that cater to various investor demographics. Among these, China A-shares and B-shares are the most prominent. Understanding the distinctions between these two share types is essential for anyone interested in the Chinese market.

What are China A-Shares?

China A-shares are stocks of companies listed on the Shanghai and Shenzhen stock exchanges, and they are quoted in Renminbi (RMB). These shares are primarily available to domestic investors, including individuals and institutional investors within China. A-shares have gained popularity due to their potential for growth, reflecting the performance of the rapidly expanding Chinese economy.

What are China B-Shares?

In contrast, China B-shares are also listed on the Shanghai and Shenzhen exchanges, but they are quoted in foreign currencies, such as the U.S. dollar or Hong Kong dollar. B-shares were introduced to attract foreign investment and are more accessible to international investors compared to A-shares. However, they still face certain restrictions and are less popular among domestic Chinese investors.

Key Differences Between A-Shares and B-Shares

- Currency Denomination:

– A-Shares: Quoted in RMB, making them accessible primarily to domestic investors.

– B-Shares: Quoted in foreign currencies, allowing foreign investors to participate more easily.

- Investor Access:

– A-Shares: Traditionally restricted to domestic investors, although recent reforms have allowed certain qualified foreign institutional investors (QFIIs) to access them.

– B-Shares: Open to foreign investors, but domestic investors face challenges, particularly with currency exchange.

- Market Dynamics:

– A-shares often reflect the sentiments of domestic investors, while B-shares are influenced more by global market conditions. This can result in different price movements and trading volumes for each type.

- Dual Listings:

– Some companies choose to list their shares on both A-share and B-share markets, providing options for various types of investors and enhancing their overall market presence.

Conclusion

The distinction between China A-shares and B-shares is crucial for understanding investment opportunities in the Chinese market. A-shares primarily cater to domestic investors and are quoted in RMB, while B-shares offer foreign investors access through foreign currencies. These differences highlight the complexities of investing in China’s stock market.

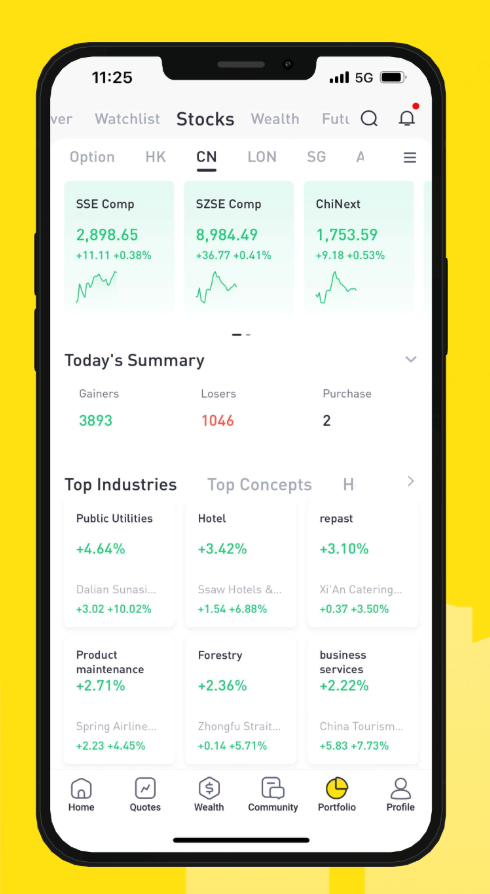

For those looking to navigate the intricacies of the Chinese stock market, Tiger Brokers offers a comprehensive platform that provides insights and tools for trading both A-shares and B-shares. With its user-friendly interface, 2500+ China A-shares and ETFs trading and advanced order types to enhance your A-Share trading efficiency, Tiger Brokers helps investors access a wide range of investment options while staying informed about market trends.